Wigmore is an innovative, purpose-led association of non-competing family offices who are passionate about collaboration and the sharing of ideas and intelligence to benefit their client families. The Chief Investment Officers of the Wigmore Association are frequently in touch given the current economic impact due to coronavirus and in this article give a market update.

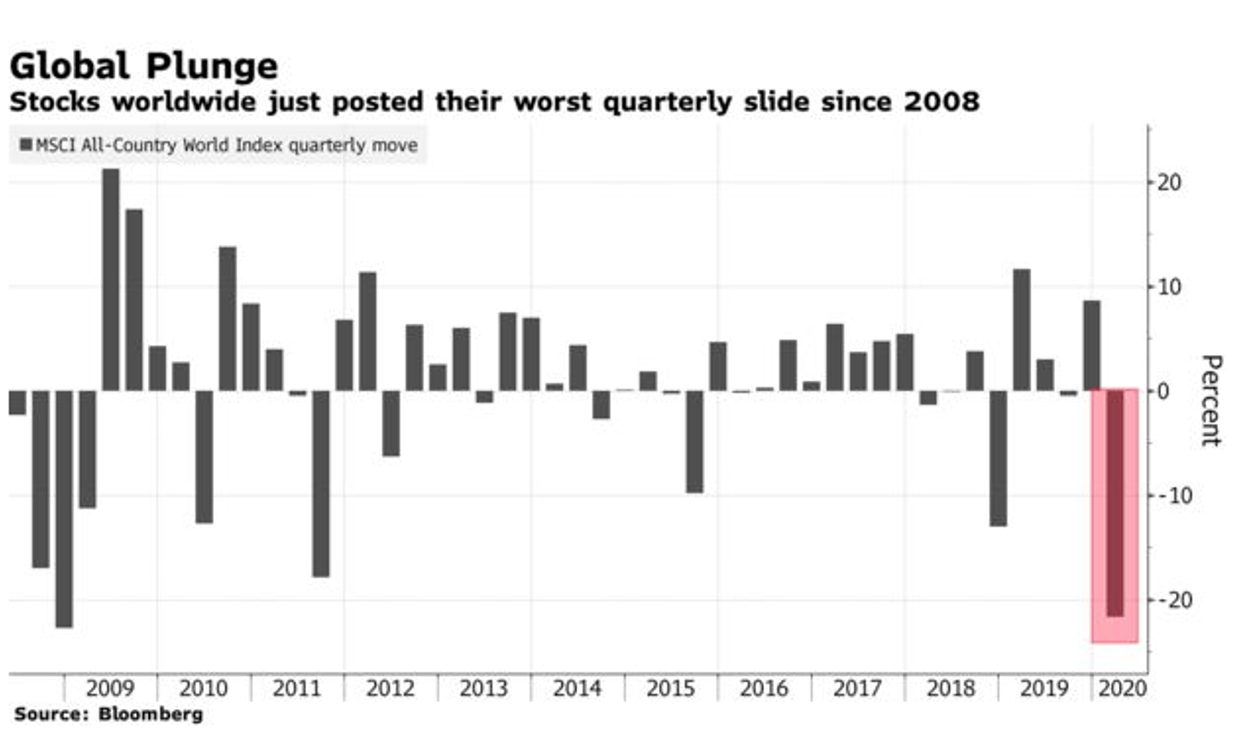

The first quarter of 2020 has just ended, and what a remarkable quarter it was! The chart below shows quarterly performance of the MSCI All Country World Index since the Global Financial Crisis of 2008.

The Covid-19 Pandemic represents an unexpected and massive shock impacting simultaneously both supply and demand and resulting in a global recession.

The widespread lockdown and social distancing measures being adopted all over the world are intended to “flatten the curve” of the disease spread. This approach will hopefully prevent health systems from collapsing, which would otherwise increase the disease’s mortality rate, as seen in Italy. These containment measures, while necessary to reduce the number of lives lost, unfortunately lead to a sudden stop in economic activity.

To counter the economic impact, Central Banks all around the world responded by slashing rates and restarting Quantitative Easing policies to provide liquidity and avoid a credit-crunch. Governments are also implementing large fiscal stimulus packages that range from tax deferrals to basic income hand-outs and credit guarantees, in order to cushion the blow to households and small and mid-sized companies.

Unsurprisingly, analysts are revising down growth forecasts and raising unemployment estimates for the next quarters. In the United States, we have seen estimates for the second quarter’s GDP ranging from a -10% to -34% annualized decline.

Many questions are floating around investors’ minds right now. These questions range from specifics of the pandemics – like what the virus’ actual propagation and fatality parameters are – to questions regarding impact on the economy and society in the short and long run. How long will the lockdowns and social distancing measures need to stay in effect? What are the risks if those measures are eased prematurely? What is the probability of a new wave of infections?

To make matters worse, oil prices have fallen towards US$ 20 per barrel: the much lower fuel demand meets a higher supply created by OPEC leaders engaging in a price war. In the long run, lower oil prices are net positive for the world economy but in the meantime, it causes significant problems for oil producers, especially those with higher marginal costs and leverage.

These high uncertainty levels lead to higher risk premiums in risky asset prices, and the price drops have pushed equities to a bear market regime, normally defined as a decline of over 20% from the market’s peak. From its highest close on February 19th to its lowest close on March 23rd, the S&P 500 Index dropped more than 33%.

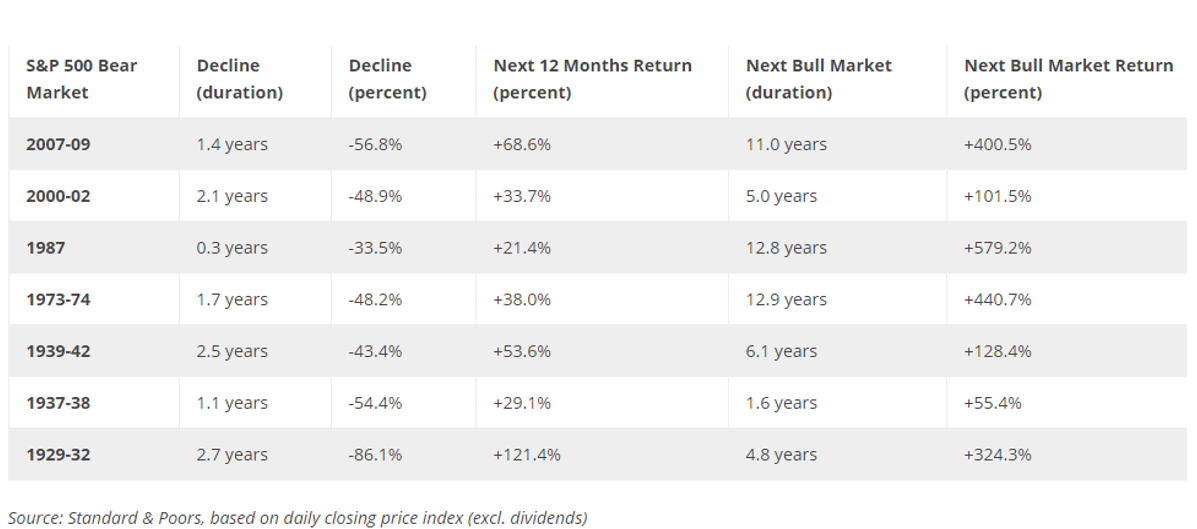

The table below shows the total decline, duration and recovery of the S&P 500 during historical market declines of 33% or more. Although each crisis had its own idiosyncratic causes, and it’s difficult to find parallels to what is currently happening, previous bear markets may be a useful contextual guideline.

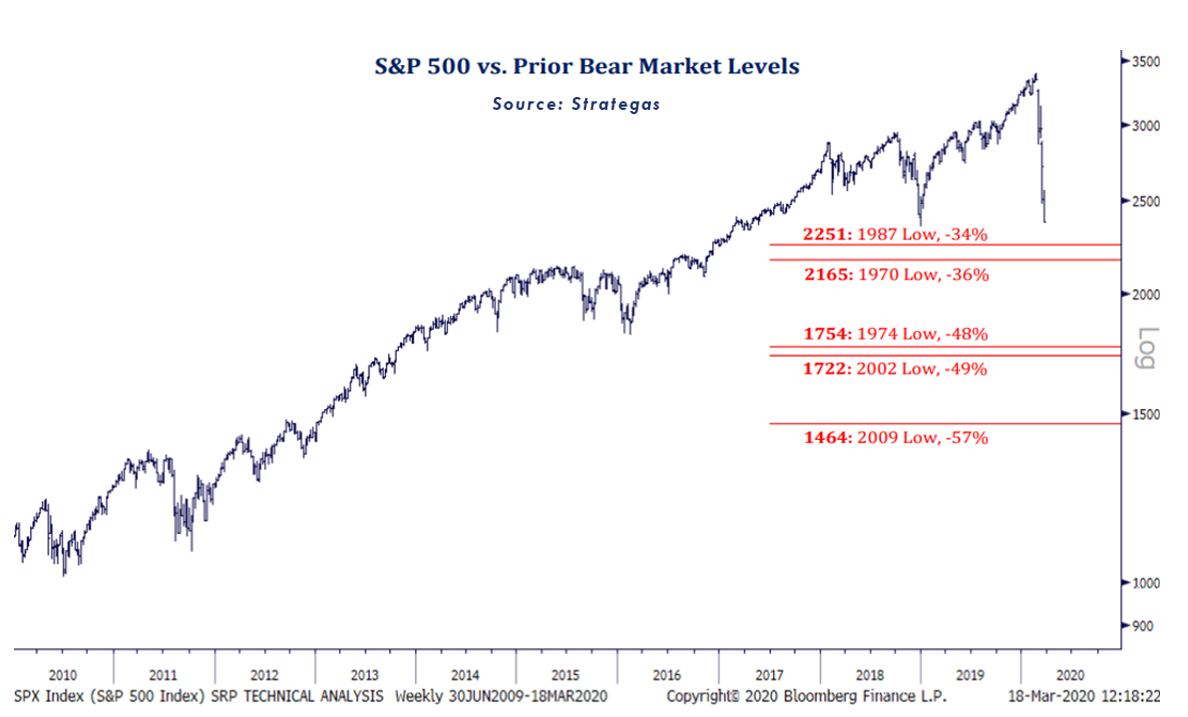

The chart below from Strategas Research Partners produced on March 18th tries to benchmark some of those bear markets to current situation.

The wide range of prior outcomes suggests the potential for additional downside, albeit without the benefit of hindsight, nobody can confidently predict where or when the ultimate low will eventually occur.

Until the pandemic has fully run its course, we are certainly going to be seeing more questions than answers, so we should prepare and expect markets to remain volatile for some time. It is critically important to not get carried away by extreme sentiments and to avoid making hasty and potentially costly errors.

What is most important is to keep our focus on the long term, maintaining discipline, adequate diversification, and adherence to our strategic investment plans. We will continue to monitor the market diligently and provide relevant updates.

In closing, please keep yourself and your loved ones safe during this unprecedented time.

Original Web Version | Wigmore Association Insights popup:yes